Senate KPERS Committee crafts new bill on working after retirement

The Senate Select Committee on KPERS met today and assembled a new proposal for changes to the rules governing working after retirement in KPERS-covered positions.

The new Senate Substitute for HB 2095 would raise the earnings cap from $20,000/year to $25,000. It would also prohibit pre-arranged agreements under which an employee retires knowing that he/she will be hired back while earning KPERS benefits.

The proposal puts limits on the conditions under which licensed school professionals could fill a position as a full-time employee exempt from the earnings cap.

These are the new conditions:

Special Education:

All special education licensed school professional positions may be filled by a retiree without an earnings limitation.

Limit on re-employment under earnings limit exception: Each retiree is limited to a total of 36 months or three school years, whichever is lesser. Retirees remaining employed after three years will be “unretired,” with benefits suspended, whether in the same position or a different position.

Employer Contributions on Special Education: Actuarial rate plus 8%.

“Hard-to-Fill” Positions:

The Kansas State Board of Education will annually certify the top five types of licensed positions that are hardest to fill. Districts may hire retirees so designated as “hard-to-fill” in the following year without an earnings limitation. Once re-employed in a hard-to-fill position, retirees may continue working without an earnings limitation, even if that type of licensed position does not continue in subsequent years to be in the list of the top five types of positions that are hardest to fill.

Limit on re-employment under earnings limit exception: Each retiree is limited to a total of three school years (36 months of re-employment) for any school employer. (A new three-year period does not begin if changing employers.) Retirees remaining employed after three years will be “unretired,” with benefits suspended, whether in the same position or a different position.

Employer Contributions on Hard-to-Fill Positions: Actuarial rate plus 8%.

Under these provisions, employers are to make ongoing efforts to recruit a permanent replacement and maintain documentation of those efforts.

Exception from Earnings Limitation for “Hardship” Positions

An employer may certify a position as a “hardship” position when a position has become vacant due to an unexpected emergency or when the employer has been unsuccessful in its efforts to recruit and fill the position. A retiree may be hired into a “hardship” position without an earnings limitation.

Limit on re-employment under the “hardship” provision: One year or one school term.

Employer Contributions on Hardship Positions: Actuarial rate plus 8%.

Employers are expected to make ongoing efforts to recruit a permanent replacement and maintain documentation of those efforts.

Grandfathering – Licensed School Professionals

Those members who have given formal notice of retirement and whose application for retirement has been submitted prior to May 1, 2015, are grandfathered. Existing working after retirement rules for licensed school professionals continue for those grandfathered retirees through June 30, 2017.

Employers pay actuarial rate plus 8% on the compensation of retirees who continue working under existing working after retirement rules for licensed school professionals through June 30, 2017.

Beginning July 1, 2017, the new working after retirement rules apply to all retirees returning to work in licensed school positions, including those who submitted their retirement application prior to May 1, 2015.

KPERS has indicated that the system takes a financial hit when retirees return to work and draw benefits between the ages of 55 and 62. For this reason, legislators are unwilling to simply extend the current law on working after retirement which is set to sunset on June 30, 2015.

The system described above and now included in Senate Substitute for HB 2095 is intended to allow working after retirement in a way that protects the fiscal integrity of KPERS while recognizing that there are times when it may be necessary to hire a retiree to fill certain positions.

Putting the proposal into a bill that has already been passed by the House means that House members will not have the opportunity to amend the bill; their only choice is to vote to concur or non-concur in the amendments.

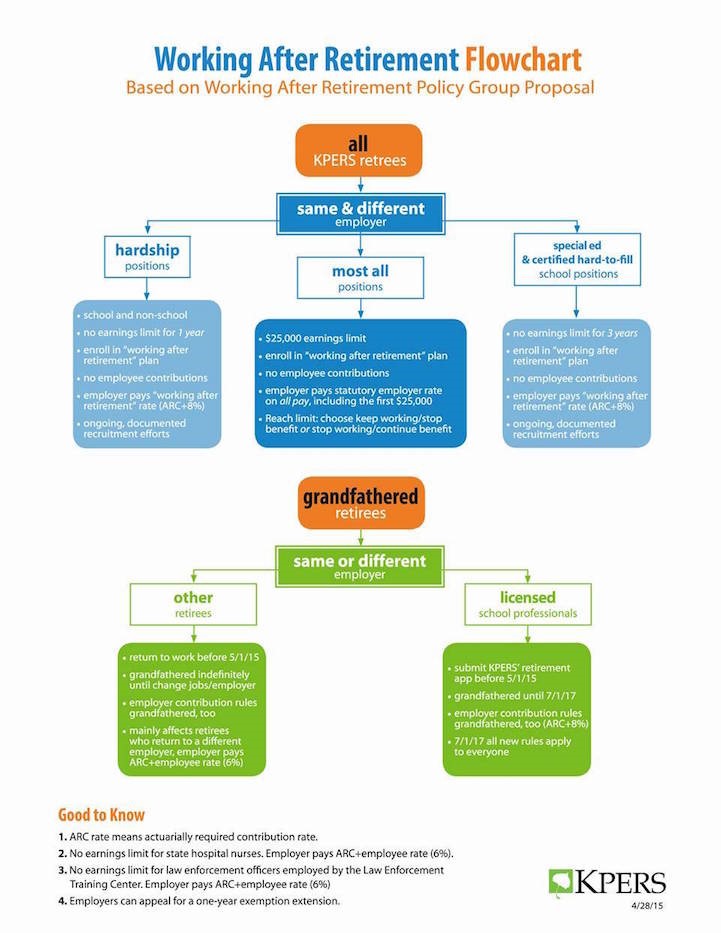

The following flow chart was created by KPERS to help explain the complexity of the proposal in Senate Substitute for HB 2095:

Meeting on the privatization of KPERS scheduled for Wednesday

There has been talk over the years of radically changing KPERS. One of those changes is a suggestion to privatize KPERS – get the state out of the business. The conversations have never gone very far.

But today, it was announced that a meeting of the House Appropriations Committee, Senate Ways and Means Committee and Joint KPERS Committee has been set for Wednesday morning to hear from financial advisors (companies) about the idea.

As announced, the meeting would have four private investment firms appear before the legislators. Those firms were Security Benefit, Prudential, Dimensional Funds, and Fidelity.

Since the announcement was made, two firms – Security Benefit and Fidelity – have declined to participate.

KNEA, along with our partners in the Keeping the Kansas Promise Coalition, will be at the meeting and following the discussion very closely.