First Gun Bill in Senate Scheduled for Hearing

First Gun Bill in Senate Scheduled for Hearing

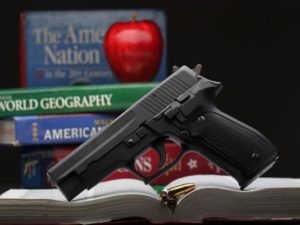

Senate Bill 53 which would create a permanent exemption for public buildings to the current gun carry law. Under current law college campuses will have until July 1, 2017 to provide security solutions that will stop guns from coming into buildings. If a college cannot provide such security – a metal detector and security at every building entrance – then they cannot prohibit the carrying of firearms in their buildings. Senate Bill 53 strikes the date. While the bill does not outright ban weapons from campuses, it allows each college to put a policy in place based on their situation.

Student, faculty, and administrative groups have all opposed the current law, wishing to keep their campuses safe. College campuses are stressful places for students. Many of these students are away from home for the first time, adjusting to new kinds of schedules, and trying to get along with roommates. They are worried about grades. They might be in new romantic relationships that can go wrong.

While colleges might prohibit firearms on campus, there is of course no guarantee that someone won’t violate the policy. That will always be a problem. But to have multiple persons pull out firearms in defense simply increases the likelihood that there will be victims. Beyond that, it creates a serious problem for law enforcement when responding to an incident. A police officer has no way, in the split seconds it takes to respond, to determine who are the “good guys” and who is the perpetrator.

The bill just came out today and a hearing has been scheduled for Thursday.

Who Among Us Prefers a Select Grade Steak Over Prime?

That is the question that came to us last night during the continued hearing on HB 2023, the repeal of the LLC income tax exemption.

The Kansas Chamber of Commerce, the National Federation of Independent Businesses, and Americans for Prosperity all claimed in their testimony against the repeal that the state of Kansas has plenty of money and before business owners should have to pay income tax like the rest of us, the legislature should cut and cut and cut spending. It’s apparently not enough that we have essentially depleted our highway fund, robbed over $100 million from employee pensions, and cut services for Kansans with disabilities in order to give the income tax exemption to business owners, we must continue on the path of service destruction.

One of their lobbyists, in response to a question about where to cut, told the committee that it was easy to “cut the fat cap off a piece of beef, but much harder to cut the marbling.” We could not think of a better analogy!

The legislature has indeed “cut the fat cap off.” And they’ve begun digging out the marbling. What they fail to remember is that the marbling is what moves a steak from “select” to “choice” to “prime.” Any lover of a good steak knows that marbling – more of it – is what makes steak taste so good. One can look at a steak and know what grade it is by the marbling.

Kansas for years provided prime grade services from education to public safety, from highways to a social service safety net. The fat cap was cut off years ago – Kansans by their nature are fiscally conservative – but there was always enough marbling to let schools go from okay to excellent, enough marbling to make our neighboring states envious of our roads and highways, enough marbling to make life better for our seniors and those with disabilities.

The last few years, legislators have been digging out the marbling. Kansans are experiencing for the first time what no marbling tastes like. It tastes sour. Kansans want better and they started demanding better last August and again in November.