Later this week, we will provide a more comprehensive review of the 2018 Legislative Session but for today, we talk about the taxing events of Thursday and Friday, May 3 and 4.

Later this week, we will provide a more comprehensive review of the 2018 Legislative Session but for today, we talk about the taxing events of Thursday and Friday, May 3 and 4.

Two highly controversial bills dominated the discussion for these two days. One was Sub for SB 284, a bill enacting the so-called “Adoption Protection Act.” (We will report on this bill later.) The other was Sub for HB 2228, the Senate’s large corporate tax giveaway and tax cut for the wealthiest Kansans.

Both were contained in Conference Committee Reports (CCR). So you understand the order of business, a conference committee report on a Senate bill goes first to the House for action while a conference committee report on a House bill goes first to the Senate. Conference committee reports cannot be amended. There is a motion to adopt the CCR which is debated and then voted on. Both chambers must adopt the report for it to go to the Governor for his signature or veto.

Because of the controversial nature of both reports and the fact that they were running almost simultaneously, it meant the atmosphere under the dome was tense.

The tax bill (Sub for HB 2228) was really the brainchild of Senate leadership, in particular, Sen. Caryn Tyson (R-Parker). The original fiscal note on the bill as it came out of the Senate and before it went to conference was a more than $500 million loss in revenue to the state. It essentially offset all of the spending increase in K-12 education.

Fiscal notes on the measure as it was debated and amended in conference changed constantly because there was no actual way to calculate the impact of changes to Kansas income taxes before the full impact of federal income tax changes were known.

The two biggest threats to the state budget included in HB 2228 were directly tied to the federal tax act passed last December.

One of these was a provision to decouple the state income tax from the federal code so that taxpayers who could no longer itemize on the federal form could still itemize on the state form. The federal code has changed so much that many filers will no longer be able to itemize. While some taxpayers may find a federal benefit (although most will not), the loss of itemization at the state level means higher revenue collections at the state level. But because those who itemize are generally the wealthiest taxpayers (Kansas estimates only about 20% of taxpayers itemize), this revenue would come from the wealthiest Kansans.

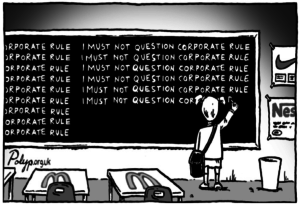

The second big item was the “repatriation” of overseas corporate earnings. Among the federal tax changes was a provision to bring the overseas earnings of multi-national corporations back to the United States for tax purposes. These corporations have long been able to essentially shelter much of their earnings overseas to avoid U.S. taxation. These earnings are now being “repatriated” – brought back to the U.S. – and taxed. Tyson wanted to block taxation of these repatriated earnings in Kansas, a measure that is essentially a big corporate tax giveaway.

So – big item number 1 cuts taxes on the wealthiest Kansans while big item number 2 allows corporations to avoid taxation in Kansas. All while providing no relief to the 80% or more of working Kansans.

On Thursday, May 3, the Senate approved the measure on the slimmest of margins 21 to 19, sending it on to the House for a vote on Friday. See how your Senator voted by clicking here.

Now our attention turned to the House where it was expected the vote would be close. As we watched discussions and followed caucus discussions, it was often unclear as to which way the vote would go.

One thing we knew for certain was that if this bill were to pass, the chances that our schools would close in August would be much greater. As it is, many people think the school funding bill passed is likely not to meet adequacy but a tax cut bill that puts the budget underwater in the second year of the school finance plan is almost certain to result in rejection of the plan. Remember the Court was clear in their earlier ruling that the state needed to demonstrate the money would be available to fulfill the promise of a phased-in funding plan.

Debate on the bill in the House began mid-afternoon on Friday. Rep. Steven Johnson (R-Assaria), as chair of the House tax committee, made the motion to adopt the report. Rep. Tom Sawyer (D-Wichita), the ranking Democrat on the committee made the arguments against the bill. Nearly every member who went to the well to speak on the bill was a conservative who supported it. They tried to persuade others that they were giving the people back what was theirs and helping the middle class. Unfortunately, the bill only provided benefits for corporations and the wealthiest Kansans, leaving most of us holding the bag for funding critical state services including schools.

With seven members out as excused absences, the vote came in at 59 to 59. It is important to know that a final action vote such as this requires 63 votes to pass and on a tie vote the bill fails. Conservatives put on a call of the House under which the doors are locked and Legislators are kept in their seats until the call is lifted. The time is then used to pressure anyone that proponents believe to be “weak” in an attempt to get the win. Often the Highway Patrol is sent out to bring absent Legislators back. A call can go on for hours.

In this case, because they were working on Sine Die, the last day, they could not go past midnight. So if people held their positions until midnight the bill would fail.

There were a number of calls to raise the call of the House but if 10 members object, it is not lifted and so the call went on and on. But no votes changed. It held at 59 to 59 until a call to raise the call was successful. Speaker Ryckman (R-Olathe) asked if there were any explanations of vote. There were none. He asked if there were any changes of vote. There were none. He closed the roll, tallied the vote, and declared the bill dead. You can see how your Representative voted by clicking here.

Another tax conference committee report dealing with motor vehicle rebates was quickly passed and the House adjourned Sine Die.

Thanks to the failure of HB 2228, there is a greater chance that schools will be open come August and that a special session is less likely. Understand that both are still possible! We won’t know until the Court finishes its review of school finance plan but had HB 2228 passed, a special session and closing of schools would’ve been almost assured.