Senate passes response to Gannon decision

The Kansas Senate debated SB 142, a school finance bill that responds to the Gannon decision by increasing school funding by about $90 million and carries that increase forward through the life of the plans passed in 2017 and 2018. In later years, funding would continue to increase by the CPI inflation factor. This action adopts the recommendation of the Kansas State Board of Education and is the same recommendation that was in SB 44, Governor Laura Kelly’s school funding bill.

The bill was advanced to a final action and then adopted under an emergency provision on a final action vote of 32 to 8. KNEA supports this action. We believe that it is past time for the legislature to act and, while there are disagreements on whether this is what the Kansas Supreme Court justices intended in their ruling, it is appropriate at this time to pass the bill and send this response to the justices for their consideration. We hope the House will take up and pass this bill as quickly as possible.

Those Senators who voted NO on the school finance bill were Republicans Larry Alley (Winfield), Dan Kerschen (Garden Plain), Ty Masterson (Andover), Mary Pilcher-Cook (Shawnee), Dennis Pyle (Hiawatha), Caryn Tyson (Parker), and Susan Wagle (Wichita).

The Senate still has to take action on the rest of the K-12 budget which is now contained in SB 147 which is in the Ways and Means Committee. We urge the Senate to pass SB 147 as well.

House committee starts hearing their alternative school finance bill

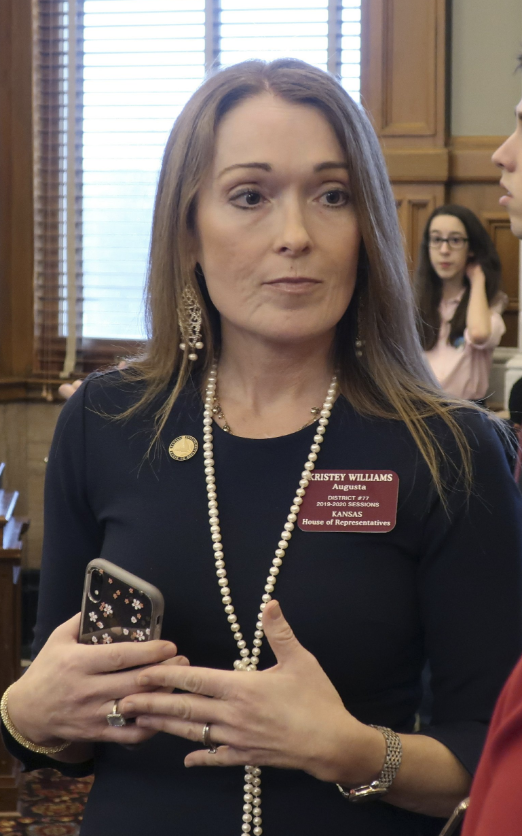

House K-12 Budget Chair Kristey Williams has brought forward her school finance bill – HB 2395 – and opened hearings on it. This bill is radically different from the Senate’s plan in SB 142.

While the Senate builds on the actions of the 2017 and 2018 actions, HB 2395 sharply reverses course. Instead of funding schools out for four years and providing increases in each year, the House bill cuts out the third and fourth years. The bill also repeals the provision in current law that increases funding to schools by a CPI inflation factor in the future.

While the Senate puts the increase on base aid, supporting all students and programs, HB 2395 puts less on base and puts some in a new mental health weighting and a small, restricted increase in at-risk funding. The bill also repeals the state’s commitment to reimbursing 92% of the excess costs of special education and cuts students off of bilingual weighting if they are not fluent in English in four years.

HB 2395 also enacts a voucher program and makes changes to the tuition tax credit (voucher) program to encourage more elementary children to leave the public schools under certain conditions.

There are numerous other policy changes in the bill to accountability requirements, to bidding capital projects, to developing budgets, and to collecting and reporting data. In fact, it reads almost like an ultra-conservative wish list. Many of these policy changes have been proposed many times in the past and but never adopted by the legislature.

KNEA strongly opposes this bill. The legislature has a simple job to do – fund the inflation factor and leave the formula – which has been deemed to be constitutional – alone. That’s what the Senate is working on. That’s what the House should do too.

During the first day of a scheduled two-day hearing Mark Desetti of KNEA, Tom Witt of Equality Kansas, Mark Tallman of KASB, and G.A Buie of United School Administrators all testified in opposition to the Williams committee bill. There were many other organizations and individual school districts submitting written testimony in opposition.

At this

HB 2395 is the wrong answer to the Gannon decision and includes many bad policy ideas that will harm students and schools.

Contact members of the committee and ask them to reject HB 2395 and instead adopt the Senate’s plan in SB 142.

Members of the committee are Republicans Kristey Williams, Kyle Hoffman, Brenda Dietrich, Renee Erickson, Steve Huebert, Brenda Landwehr, Adam Smith, Sean Tarwater, and Adam Thomas. The Democrats are Valdenia Winn, Cindy Holscher, Nancy Lusk, and Jim Ward.

Senate adopts Brownback 2.0 tax plan

The Senate voted on a motion to concur in the House changes to SB 22, the corporate tax giveaway bill that was expanded by the House.

As the bill originally passed the Senate it would provide about $190 million in tax cuts aimed at multi-national corporations and wealthy individuals. Passage of the bill represents a partial return to the failed tax policies of former Governor Sam Brownback. While in office, he was devoted to “trickle-down economics” under which the state grants massive tax cuts to the wealthy and corporations in the hope that the benefit will “trickle down” to working men and women in the form of more jobs and higher wages.

Instead, the Kansas state budget collapsed, services were cut, and desperate measures to balance the budget had to be enacted resulting in hikes in the sales tax, the devastation of the state highway plan, and the diversion of KPERS payments. Those service cuts have brought Kansas a compromised foster care system, prison riots, and crumbling infrastructure.

When SB 22 went across the rotunda, the House not only endorsed the cuts in the Senate version, they added a small reduction in the food sales tax (one cent) and a provision intended to force more online retailers to collect and remit sales tax. Despite the internet sales tax provision, the cost of the bill to the state budget went up even more.

While we believe a action on the food sales tax is needed in order to help low-income families, this bill is not the way to make that happen. Kansas needs to fund our schools, restore vital services decimated by the 2012 tax cuts, and balance the budget. Once we have fully recovered, it is appropriate to examine our entire tax structure to make it balanced across all tax sources and fair to both businesses and individuals.

In 2017, the Legislature reversed most of the Brownback disaster and today the state is in recovery. As we fight to address the disastrous fallout of the Brownback policy, the last thing Kansas needs to do is start taking up more large tax cuts aimed at the wealthy and corporations. Trickle down doesn’t work! It’s time to stop pretending that it ever will.

The Senate voted to accept (concur in) the House changes to the bill on a vote of 24 to 16. With this action the bill now goes to Governor Kelly who is expected to veto it. It would take 27 votes in the Senate and 84 in the House to override a veto.