Tax talks

Thanks to Governor Brownback’s reckless income tax cuts of 2012 and 2013, the state faces a budget gap of about $800 million over the next two years. Filling that gap will require either raising taxes or massive cuts to services.

Legislative committees were briefed on the gravity of the situation as they returned from the April break and it’s taken until now for ideas to come forward other than the Governor’s proposal to raise tobacco and liquor .

There is little legislative interest in the tobacco and liquor tax proposal and no one in the Legislature or the Administration has yet proposed rolling back the income tax cuts that caused the problem. Instead, legislators are looking at “consumption taxes.” That’s just a fancy way of saying “sales tax increase.”

During the depths of the great recession, Kansas temporarily raised the sales tax from 5.7% to 6.3% to shore up a budget pounded by the economic collapse of 2008-09. The rate was set to return to 5.7% but to pay for the reckless tax cuts the Legislature, at the request of Brownback, reversed course and kept the rate at 6.15% where it is now.

A proposal gaining traction in the House is to raise the sales tax to 6.5% which would generate about $163 million in revenue. Sales tax increases are popular among legislators because they believe you won’t notice. They know that when you file your income tax, you actually see how much you’re paying. And when you get your property tax notice, you see exactly what you owe. Both of those can be large numbers. But sales taxes nickel-and-dime you. It’s hard to see just what you’re paying in sales tax because it is applied in small amounts here and there. One is tricked into thinking it’s not very much.

The Kansas tax system is one of the most regressive in the nation, thanks to our reckless tax cuts passed in 2012 and 2013. Sales tax is the biggest culprit. It represents a large percentage of a low income earner’s salary. Since Kansas is one of only 14 states that imposes a sales tax on groceries, this makes the tax even more burdensome for the poor. To make matters worse, in order to soften the blow of his income tax cuts, Brownback also repealed the sales tax rebate on food that helped offset the burden for the poorest Kansans.

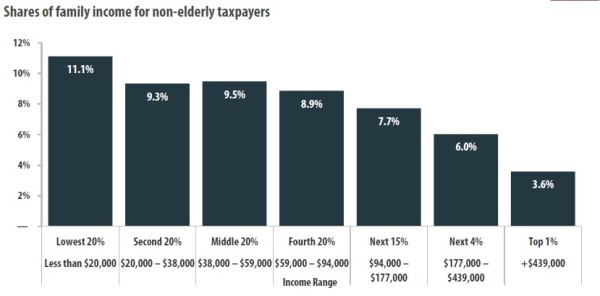

Overall, the poorest 20% of Kansans pay 11.1% of their income in taxes while the wealthiest 1% of Kansans pay only 3.6%. This is the hallmark of a regressive, unfair tax system – the more one earns, the less one pays in taxes as a percentage of income. This will only get worse with an increase in the sales tax.

This chart from the Institute for Taxation and Economic Policy (ITEP) shows the percentage of income paid in taxes by each quintile of taxpayers in Kansas. The wealthiest quintile is further divided into 15%, the next 4%, and the 1% of wealthiest Kansans. The data is for 2015. (http://www.itep.org/whopays/states/kansas.php)

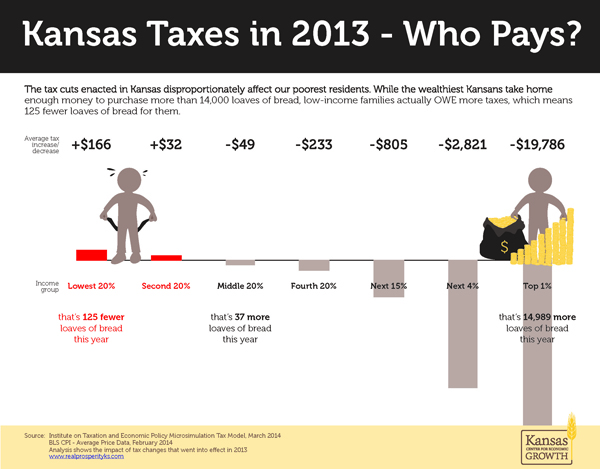

This chart shows the impact in 2013 of the tax cuts enacted by Governor Brownback. (http://realprosperityks.com/kac/wp-content/uploads/2014/04/who_pays.jpg)

AFP carpet-bombs Kansas with anti-tax mailers

Are you one of the many Kansans getting mail from Americans for Prosperity lauding certain legislators for promises to not raise taxes and urging you to call them and tell them to stick to the pledge?

AFP – an organization founded and funded by the Koch brothers – wants the Legislature to gut state services in order to protect the tax cuts that have benefited only the wealthiest Kansans.

While schools are having to close early and beg for some extra money from the SB 7 “extraordinary needs fund” and road projects are being set aside as the Legislature drains the highway fund of money, AFP is advocating that legislators do nothing to solve the revenue problem but instead focus on destroying state services.

When is a dollar not a dollar?

The answer in Topeka is simple – when it’s a tax dollar returned to a corporation.

Last year the Legislature passed a tuition tax credit bill for corporations. In a move to begin the privatization of public education in Kansas, the Legislature passed a bill providing for a 70% tax credit for any corporation that would entice a child out of a public school by giving that child tuition money for a private school. They did put some limits on the bill, requiring that the student would have to be a low-income student from a Title I priority school.

If a corporation gave that student $8,000 in tuition money, the state would allow the corporation to cut $5,600 from their state tax bill. The $8,000 tuition bill would only cost the corporation $2,400.

Some legislators would like to expand this bill so that any student would qualify. Private schools could work with corporations to find the most brilliant students or the most athletic students and get their tuition paid. Private schools under this bill do not even have to be accredited – the state would be losing $5,600 in tax revenue for every student getting his/her tuition paid at an unaccredited school!

Supporters of this idea would have you believe this does not cost the state anything. In reality, it does. It costs the state up to $10 million in lost tax revenue that could be put to funding public education, reducing social service caseloads, or repairing roadways.